Incentive compensation planning is a complex subject. Your compensation framework must be internally equitable, externally competitive and compliant as per the pay and labor laws. Incentive compensation is a variable pay that is given to deserving candidates for outstanding performance. It includes bonuses, company stocks, retirement plans, tour packages and many more.

The objective of any sales team is pretty clear: sell more and drive revenue. Today, most of the organizations are offering mixed pay structure, includes basic salary with commission-based pay. These structures have led to the practice of Incentive Compensation Management (ICM), which includes compensation planning and processing.

Champions of the industries like FMCG, CPG, Food & Beverages and Pharmaceutical industry are like a big Banyan tree whose roots are spreaded deeper within earth. Similarly the champions are champions because of their on time presence across the length and breadth of the global market and their quick response to the market demand. Your success in these above mentioned industries depends on effective distribution management and with manual methods you cannot achieve that. Without having real time market insights you cannot survive in today’s highly competitive business world. That’s why the demand for the distribution software is very high.

Here are the obstacles faced by organizations managing distribution manually.

Industries like FMCG, Pharmaceuticals and Food & bevarages are looking for various solutions like distribution software, supply chain management software, customer relationship management software, sales force automation software and many more to streamline, integrate and automate the overall processes to bring end-to-end visibility, transparency and control.

Due to the globalization, digitization, ecommerce and Govt. initiatives to boost investment, the level of competition is being fierce and with that the loyalty level of partners and customers are decreasing day by day. They realized that with age old stereotype strategy they cannot win this battle. So these industries have tighten their sit belts to bring innovation in their strategy and processes.

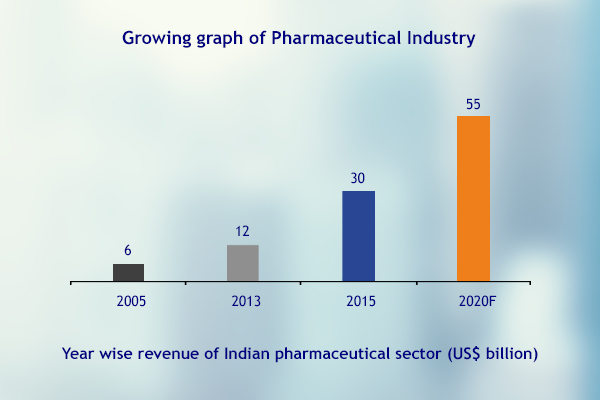

Indian Pharmaceutical market is growing very rapidly, is the 3rd largest in terms of volume and 13th largest in terms of value. The Indian Pharmaceutical market increased at a CAGR of 17.46% in 2015 from US$ 6 billion in 2005 and is expected to expand at a CAGR of 15.92 per cent to US$ 55 billion by 2020.By 2020, India is likely to be among the top three pharmaceutical markets by incremental growth and sixth largest market globally in absolute size. Here are some of the statistics as a evidence of groth of overall Pharma industry.

FMCG, Food and beverages, Pharmaceuticals and Life science are few of the industries in which if you want to establish and grow, you have to be the champion in distribution management and an agile order management software is quintessential weapon for becoming the champion. Let’s understand the pain areas of tradition order management practice.

- Are you still following hybrid pen and paper based order booking?

- Do you often encounter errors, delays and customer complaints?

- Are you losing your credibility for not meeting the dead lines?