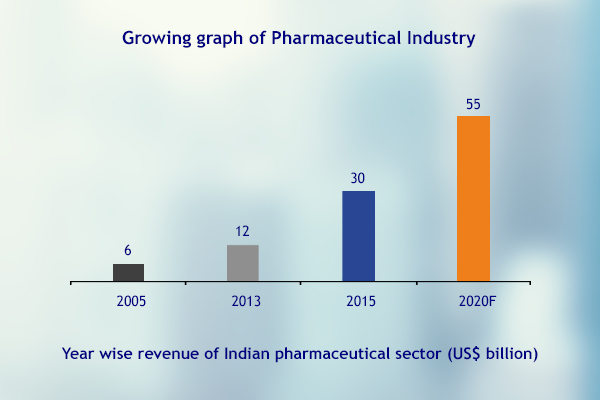

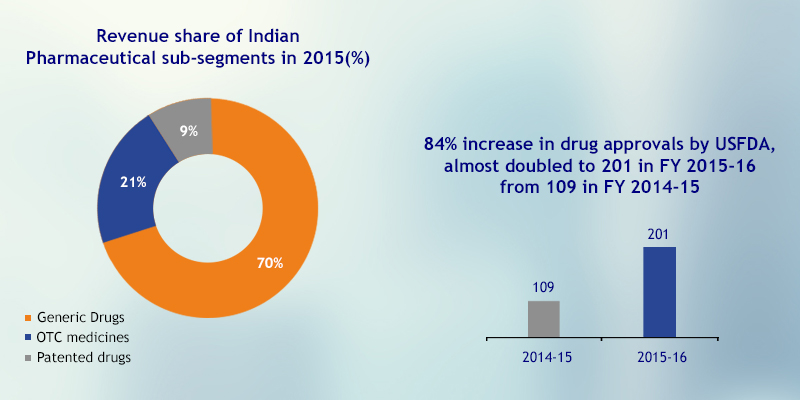

Indian Pharmaceutical market is growing very rapidly, is the 3rd largest in terms of volume and 13th largest in terms of value. The Indian Pharmaceutical market increased at a CAGR of 17.46% in 2015 from US$ 6 billion in 2005 and is expected to expand at a CAGR of 15.92 per cent to US$ 55 billion by 2020.By 2020, India is likely to be among the top three pharmaceutical markets by incremental growth and sixth largest market globally in absolute size. Here are some of the statistics as a evidence of groth of overall Pharma industry.

Currently around 67 per cent of India’s population or 742 million people live in rural areas, but rural markets contribute to only 17 per cent of the overall pharma market’s sales’, consulting firm Pricewaterhouse Coopers (PwC) pointed out in its latest report, ‘India’s Pharma Inc: Capitalizing on India’s growth potential’.

The report further highlights that this low penetration represents a huge opportunity for the pharmaceutical companies to expand in the rural markets, which are expected to be the growth drivers for the domestic pharma industry in the coming years.

The domestic pharma industry is indeed witnessing trends of increasing penetration in rural areas. But penetrating rural market is not very easy and require innovation and improvisation in current distribution system applied for urban India. Let’s go through the challenges faced by the companies during rural penetration.

1. Undefined Distribution EcosystemGenerally Pharma companies follow stereotype distribution system like manufacture to C&F agents to stockist to wholesaler to retailer but in rural area this could not work. These stake holders don’t have much visibility in rural areas hence pharma companies face deficit of financially sound business partners to distribute. Due to such an undefined ecosystem, both the distribution of stocks and the collection of payments becomes a challenge for companies.

2. Poor AccessibilityAnother major road block Pharma companies face is the distance and poor infrastructure. To ensure operational effectiveness and coverage medical reps have to travel extensively from the hub, carring sales stock to cover 10-12 doctors and handful of retailers. These mammoth efforts sometimes don’t fetch the desired returns. Local medications and quacks are other impediments to penetrating the rural market.

3. Purchasing Power of PatientsDue to low income and high cost of medicines, people ask for part prescriptions, cheaper substitutes and delay in treatment.

4. Counterfeiting and KnockoffsThe biggest challenge companies face is counterfeit medicines which are available in the name of popular brands, such as Voveran, Betadine, Crocin, and Cosavil. There are more than hundred brands for each off-patented drug and it is difficult for regulating authorities to detect the knockoffs and counterfeits.

Moreover, lack of proper lab facilities near rural areas, inadequate number of drug inspectors, ambiguous regulations, procurement of unauthentic drugs by chemists, and lack of awareness among patients are the factors that lead to rise of fake drugs in rural markets.

These are the obstacles that Pharma companies face during penetration. These obstacles are actually the signal for the Pharma companies to improvise their sales and distribution system for more market penetration in rural market.

1. PiggybackingIn-spite of trying to create their own network Pharma companies should use a ‘piggyback’ distribution model. The ‘piggyback’ model suggests utilizing the distribution network of those companies that have different product offerings and a good reach in specific areas. Where one ‘rider’ (a Pharma company) utilizes a ‘carrier’ (e.g., an FMCG company) distribution channel and get its product distributed.

2. Enhance the reachPharma companies generally rely on their distribution channel or key opinion leaders (KOL’s). KOL’s are the doctors who prescribe medicines. But in rural India strategy should be different so they are doing various things like heath camps, free checkups, out sourced the field force, local radio stations, Kan Khajura Tesan and mobile medical vans etc. for enhancing the awareness level and market reach.

3. Low-cost branded genericsTo keep the cost of medicines affordable for rural areas. Companies have started to create separate business units for rural markets. These units promote medicines that are commonly prescribed by doctors in these markets and at affordable price. This low-cost strategy becomes mandatory for companies entering the rural market in order to remain competitive with respect to unbranded generics.

4. Anti-counterfeitingTo encounter counterfeiting, companies are coming up with innovative ideas like innovative packaging and including unique ID that can be traced and matched with the manufacturing batch number to differentiate from the duplicate version of drugs available in the market.

The concept of rural markets in India is still in a primary stage and this market poses wide range of challenges, such as understanding the dynamics, strategies to supply, and compliance with the rural consumers.